About Us

Kapstream Capital (ABN 19 122 076 117, AFSL 308870) was founded in 2006 by Kumar Palghat and Nick Maroutsos, both seasoned fixed income portfolio managers.

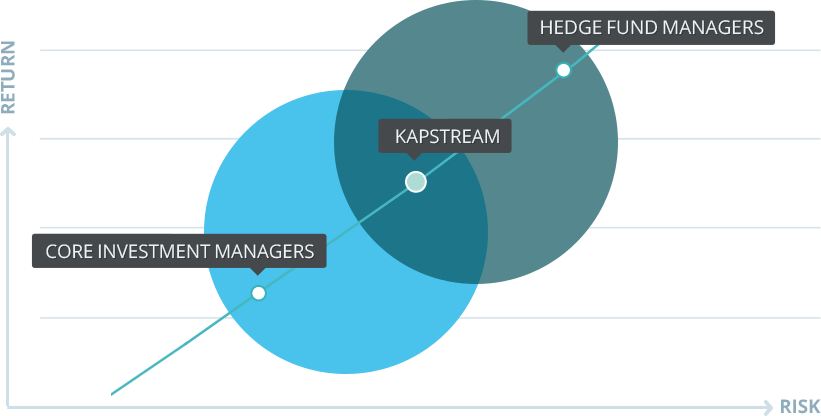

Kapstream was founded on a simple belief; that by removing the constraints inherent in conventional benchmark-relative fixed income portfolio strategies, and by setting absolute return targets and absolute risk limits, portfolios could be constructed using predominantly investment grade assets that more closely met the true requirements of investors in preserving capital, providing liquidity and delivering consistent and positive absolute returns.

Until then, more conventional fixed income managers typically built portfolios around issuance-based bond benchmarks – skewed to the largest borrowers, often not those offering the best return potential – who were more focused on preventing benchmark tracking error than delivering the best return potential. Kapstream concluded that they could consistently achieve positive results by going beyond the traditional core manager approach.

They decided to use a wide range of instruments including derivatives to exploit market inefficiencies across the full spectrum of fixed income investments, combined with the flexibility to move meaningfully into cash and government bonds at times of market uncertainty and stress.

Fixed Income Manager Universe

Kapstream today

Today Kapstream manages A$11 billion from offices in Sydney and Newport Beach, California, mostly under the firms flagship global absolute return strategy. Since July 2015 Kapstream has operated as an autonomous ’boutique’ subsidiary, initially of Janus Capital Group and – since their merger in May 2017 with Henderson Global Investors – now of Janus Henderson Investors. Kapstream has always believed in an outsourced business model, appointing external service providers to undertake all non-investment activities, so that we may stay entirely focused on what we do best; investing and managing fixed income portfolios. All back office, administrative and retail distribution services continue to be provided by long-term business partner Fidante Partners Limited, part of the Challenger Limited group of companies. Kapstream has been a keen and long-term supporter of a number of domestic and international charities. Our charitable program currently supports the following causes:

- 2.0bn Kapstream Absolute Return Income Fund

- 0.5bn Kapstream Absolute Return Income Plus Fund

- 0.1bn Kapstream Private Investment Fund

- 1.9bn Segregated Absolute Return Income Portfolios

- 7.8bn Janus Henderson US Absolute Return Income Funds

- 0.2bn Janus Henderson US Absolute Return Income Plus Funds

The global absolute return fixed income specialist.